Watchlist Tips & Tricks

Tip #1

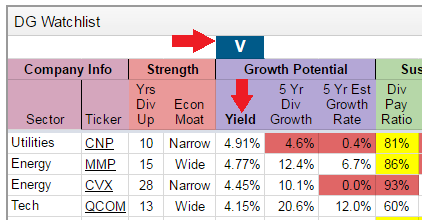

At the bottom of the Watchlist there are four tabs that you can click on to sort the Watchlist by, they are Yield (the  default screen), Dividend Growth rate, % Fair Value, and Quality Score. These are four important qualities to begin your search when looking to purchase a dividend growth stock. I like to use all four of these when searching starting from the left tab and working to the right. My minimum requirement for initial yield is 2.5% and a dividend growth rate of at least 5%. I’m willing to purchase companies at or below fair value, but not overvalued. Overvalued stocks are indicated with red highlighted cells in the ‘% Fair Value’ column. The way I use the ‘Quality Score’ is to find the stronger overall quality when comparing multiple candidates against each other.

default screen), Dividend Growth rate, % Fair Value, and Quality Score. These are four important qualities to begin your search when looking to purchase a dividend growth stock. I like to use all four of these when searching starting from the left tab and working to the right. My minimum requirement for initial yield is 2.5% and a dividend growth rate of at least 5%. I’m willing to purchase companies at or below fair value, but not overvalued. Overvalued stocks are indicated with red highlighted cells in the ‘% Fair Value’ column. The way I use the ‘Quality Score’ is to find the stronger overall quality when comparing multiple candidates against each other.

Also, there is a down arrow “V” indicator in a blue box at the top of the column to help distinguish that this is the column being sorted.

Tip #2

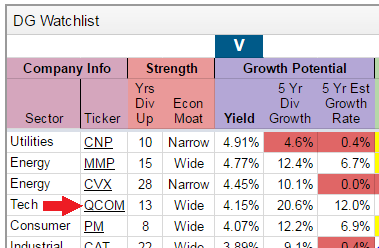

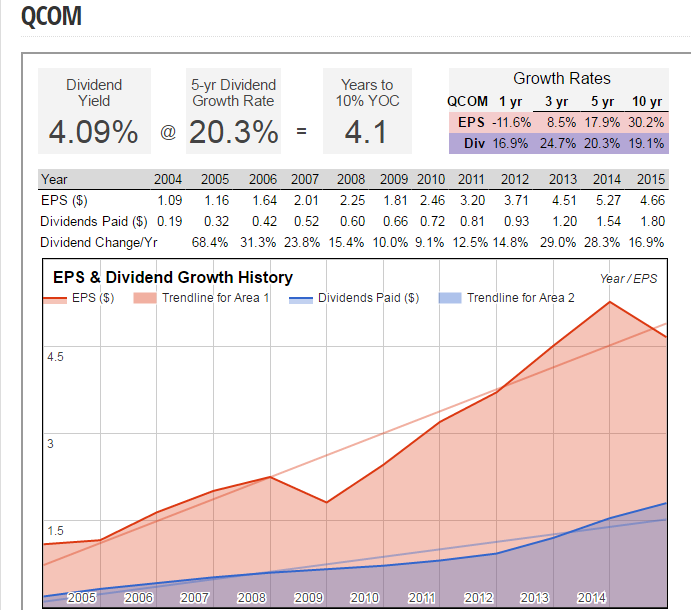

Each underlined stock ticker symbol listed on the watchlist is a link. Once you find some interesting prospects from your first pass you can drill down a little deeper by clicking on this link to redirect you to a page with two valuable 10-year history charts. The top chart illustrates the companies Earning Per Share (EPS) and Dividend Growth history. The bottom chart is the Dividend Payout Ratio History which correlates with the data of the top chart (EPS & Dividend Growth). Combined these charts will give you exceptional insight to each stocks growth rate history and trends.

Tricks

At the top of the company 10-year history page you’ll find the number of years it will take for that stock to reach a 10% yield-on-cost based on its current yield and 5-year dividend growth rate (in the QCOM example, it is 4.1 years, assuming it can maintain the 20.3% dividend growth rate). For a larger perspective of the relationship between initial yield and the dividend growth rate you can click on the ’10×10 Score’ button on the top menu bar. I prefer to purchase stocks that have a high enough combined yield and dividend growth to reach a 10% yield on cost in 10 years or less.

Filed in: Dividend Growth Investing • Investment Principles • Website Tools

Comments (6)

Trackback URL | Comments RSS Feed

Sites That Link to this Post

- pitch deck template free ppt | October 1, 2021

- https://semanticweb.cs.vu.nl | April 3, 2023

- accelerator startup | July 19, 2023

- www.cbn.com | August 15, 2023

- we-grow.dk | August 25, 2023

Thanks for pointing these features out. I didn’t notice them before, and they were useful in analyzing some stocks this weekend.