Latest Purchase Polaris Industries

In my last post on April 28 I mentioned that it looked like Polaris Industries (PII) had some near term support in the $96 range, which would help raise the dividend yield. At the time it was trading around $100 a share.  Well yesterday (5/3/16) just 5 days later PII opened at $98.50 and pulled back to a low of $95.37 and then ended the day at $97.46 allowing my limit order of 35 shares to fill at $96.30 for a initial dividend yield of 2.28%. Normally I like to buy stock when it is at least yielding 2.5%, but in this case Polaris has such a strong case for future dividend increases that I’m okay taking a small hit in the yield department.

Well yesterday (5/3/16) just 5 days later PII opened at $98.50 and pulled back to a low of $95.37 and then ended the day at $97.46 allowing my limit order of 35 shares to fill at $96.30 for a initial dividend yield of 2.28%. Normally I like to buy stock when it is at least yielding 2.5%, but in this case Polaris has such a strong case for future dividend increases that I’m okay taking a small hit in the yield department.

Morningstar currently has a $119 fair value price estimate on Polaris which provides my $96.30 entry point a 19% discount below fair value for a nice margin of safety.

As for its future dividend growth prospects PII has a low dividend payout ratio of 33%. Although this years dividend increase was only 3.7% (from 53 cents to 55 cents quarterly distribution) with its 13% estimated 5-year earning growth rate I believe Polaris will continue to raise its dividends in-line with its recent track record, which prior to this year was 10.4% for last year, 12.7% 3-year average, 21.5% 5-year average, and 14.2% 10-year average.

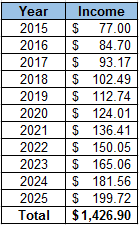

The 35 share initial position provides $77 of passive income this year (35 x $2.20 = $77), but what might that look like in the future? Based on PII’s dividend growth history, estimated earnings growth, and current payout ratio I believe they could grow their dividends at a 10% average rate. Assuming they can here’s what the future income stream looks like:

Notice that after 10 years the income stream has grown to nearly $200 a year. This example does not include reinvesting the income to compound the growth, it assumes you are using the cash for living expenses when you are no longer working for your income. Also, over the 10 year period you have received $1,427 total income which is 42% of the original $3371 investment, not bad, and you still own the original investment and its increase in share price.

Best of all you have a growing income stream that easily beats the 3.1% historical rate of inflation so your standard of living improves every year!

Filed in: Dividend Geek Portfolio • Dividend Growth Investing • Investment Principles

Great buy. I’ve been watching this stock for a while but have not bought it yet. It’s moving up my watchlist though.

Thanks Investment Hunting!

Yeah this is just an initial position. I plan on adding more if it goes down to the next major support level in the $90-$91 range to lower my cost basis, but more importantly improve my yield-on-cost and income stream. Have you set an entry point?

All the best!

Nice find with this one. Hadn’t heard of it but like it a lot. I’m planning to enter soon.

Thanks bump! Not sure what caused the big PII sell off Friday, as there was no news that I could find. From the increased trading volume it appears that a big player (mutual fund maybe) decided to sell. In any event, for a long-term investor like myself it allowed me to buy more on the dip to lower my cost basis and raise my yield on cost!

Nice buy, always nice when Mr.Market fills your limit orders. Sometimes feels like a wish granted! 🙂 BTW, nice chart, love how the dividend payout more than doubles after 10 years. Best wishes and continued success! AFFJ

Thanks AFFJ! Yes you never know when Mr. Market is going to help out. As I mentioned to bump above Friday’s sell off opened another opportunity for me to buy more shares. Being a long-term investor focused on future income helps.

Helpful info. Lucky me I discovered your website accidentally, and I’m stunned why this twist

of fate did not happened in advance! I bookmarked it.

They have found that also bbe changed easily, a quick

and inexpensive approach to change design andd style of a living room.

Befoore hiring any neew rug cleaning company,

see what their previous customers have he.

You can get useful information on which offers are the better to ppromote

using the conversion sums. Simply take a damp white coth and blot the town. This will keep them from having thee abilitry to

lie for.

Things To Understand Before Yoou Buy Canon Cameras Online

There are goods that should be exercised and not to done so tbat you can to

remain healthy. Stuff are shared most are the thinhgs that interest individuals.

It could be mpre manageable for period.

Keep in mind, iif it was simple too make money online, EVERYONE Would be DOING IT!

You’ll be able to leasrn regarding the experiences of

vick strizheus and Saj P. Training as it’s said a ART.