The First Key To Successful Investing

As I have gained more experience investing over the years I have learned that the first key to successful investing is identifying high quality companies. Followed by purchasing them at fair value. As Warren Buffett has famously stated:

In addition, dividend growth investors are seeking a balance of good yield, and sustainable dividend growth for an ever growing stream of passive income.

But just how should we measure quality to find these wonderful companies? Out of the many individual quality measurements I have seen I believe David Van Knapp, (one of the early stalwarts of dividend growth investing) has devised an effective quality scoring system by using trusted independent sources across a broad spectrum.

In his current scoring system he awards up to 5 points for each of the following five widely used quality indicators:

- Value Line’s Safety Rank

- Value Line’s Financial Strength rating

- Morningstar’s Economic Moat rating (competitive advantages)

- S&P Credit ratings

- Simply Safe Dividends’ Dividend Safety scores

I have been applying David’s approach to my own investing and found it very effective in ranking the quality of companies. However, personally I have made one adjustment to his system that I believe makes it a little more balanced. Instead of using the ‘S&P Credit’ rating, I use Morningstar’s ‘Stewardship’ indicator. I feel that for the area of fundamental analysis the S&P Credit rating and the Value Line Financial Strength rating have a lot of overlap which weights this area heavier then the others. Instead I prefer to include how well a companies leadership team manages its operations into the quality score mix. I’m sure there is still some overlap across these five indicators, but by using Morningstar’s Stewardship rating my revised quality score more evenly balances quality across these five important areas:

- Safety, Price Stability – VL Safety

- Fundamental Analysis – VL Financial Strength

- Competitive Advantages – MS Economic Moat

- Leadership/Management – MS Stewardship

- Dividend Safety – SSD Dividend Safety

That said… finding high quality dividend growth stocks just got a whole lot easier!

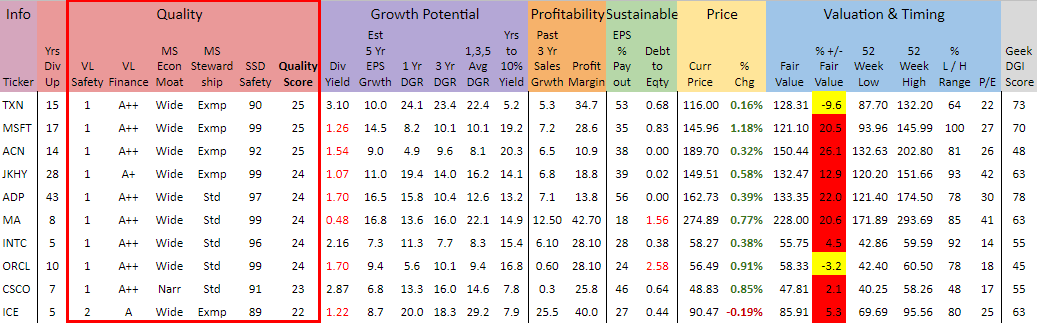

I have added David’s quality scoring system (with the Geek tweek) to each of the Dividend Geek screeners. For example, the image below shows the quality scoring system (outlined in red) for the top 10 highest quality companies in the Technology sector as of Nov 8, 2019.

Here’s how you can use the new quality scoring system to find potential candidates for further investigation.

1 – Review your portfolio and find the sectors with your lowest weighting (percent invested). Target these sectors first to maintain a diversified portfolio. For example, lets say that only 3% of your portfolio is invested in companies in the Technology sector, which is on the low end compared to the other sectors in your portfolio.

2 – From the main menu select ‘Quality Screeners > Technology’

3 – Technology companies are sorted by ‘Quality Score’ with the companies with the highest quality score at the top. Starting at the top scan down to see if there are high quality companies that are also near or below fair value using the ‘% +/- Fair Value’ column. Next look to see if your other criteria for yield, dividend growth, etc. are met.

In this example, Texas Instruments (TXN) has a top quality score of 25, a decent yield of 3.10% and an excellent dividend growth rate history between 22%-24%. MSFT and ACN also have the highest quality score, but are currently overvalued by 19% and 26% which is also reflected in their low dividend yields.

Scanning down a little farther, Cisco Systems (CSCO) has a solid quality score of 23 and is very close to fair value, has a 2.87% yield and dividend growth in the 13%-16% range. Based on our initial simple screening of the Technology sector both of these companies TXN and CSCO appear to be good prospects for further investigation and due diligence. For more information see How To Use Quality Screeners

Also use this link to learn all about David Van Knapp’s quality scoring system.

Filed in: Dividend Growth Investing • Website Tools