Highest Quality Undervalued Dividend Growth Stocks – General Dynamics (GD)

Based on a 5-factor high quality scoring system that uses independent data from Value Line, Morningstar and Simply Safe Dividends, where 5 points is awarded for the highest score for each of the following:

- Value Line Safety (Safety, Price Stability)

- Value Line Financial Strength (Fundamental Analysis)

- Morningstar Economic Moat (Competitive Advantages)

- Morningstar Stewardship (Leadership/Management)

- Simply Safe Dividends (Dividend Safety)

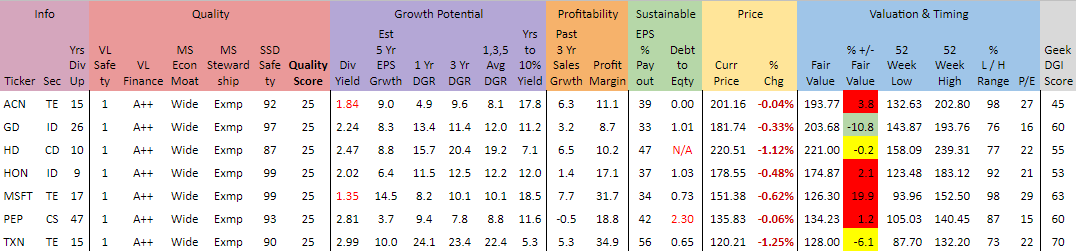

Let’s take a look at General Dynamics (GD) an elite company with a perfect quality score of 25 points for a potential buying opportunity and possible entry points. The image below was taken from our ‘Highest Quality’ screener.

With high quality established for GD by our quality scoring system, let’s focus on the other three areas prized by dividend growth investors: value, yield, and dividend growth rate when selecting stocks. Here is my basic selection criteria and process when screening dividend growth stocks for possible further investigation.

- Value – Near or below fair value

- Yield – 2.0% or better but I’m flexible depending on the dividend growth

- Dividend Growth – 5% or better but I’m flexible based on the initial yield

- Years to 10% Yield – 10 or less years, but I’m flexible out to 12-13 year range with high quality companies. This is a formula that produces a checks and balances between yield and dividend growth rate. For example, the lower the yield the higher the dividend growth will be needed to reach a 10% yield-on-cost within 12 years. Likewise, a low dividend growth rate will require a high initial dividend yield to meet the 10% yield-on-cost in 12 years. See the ‘Years to 10% Yield‘ page for more information on how to use this metric.

General Dynamics (GD)

Looking at the shaded ‘% +/- Fair Value’ column notice that General Dynamics (GD) is currently trading at 10.8% below fair value (based on an estimated $203.68 fair value price) at the Nov 29, 2019 closing price of $181.74. BTW, our fair value estimates are the average of two value metric’s: 1) Morningstar’s fair value, and 2) The Average 5-Year Dividend yield method.

In the case of General Dynamics, here are the fair value breakdowns:

- Morningstar’s fair value estimate = $188.00

- Average 5-Year Dividend method = $219.35

- Average of the two methods = $203.68

Screening Review

- Yield

- 2.24% (at current price of $181.74)

- 2.33% (at midpoint of support range $175)

- Dividend Growth – 12.0% (the average of the 1, 3, and 5 year averages)

- Years to 10% Yield

- 11.2 (at current price of $181.74)

- 10.9 (at midpoint of support range $175)

- Value

- 10.8% below fair value (at current price of $181.74)

- 14.1% below fair value (at midpoint of support range $175)

- Technical Analysis

- $180 – $175 recent support range

- Currently trending down towards $180

- Possible buy points $180, $177.50, $175

Summary

General Dynamics (GD) is a high quality company with a perfect 25 point quality score that is currently trading 10% below fair value. It has a low but acceptable dividend yield of 2.24%, but an excellent dividend growth record in the 11-13% range. Combined these two metrics produce an acceptable 11 years to reach 10% yield on cost.

General Dynamics passes the dividend growth investing screening review to be considered for further investigation. Always to your own due diligence. Please feel free to comment to let me know if this type of screening analysis is helpful.

Disclosure: Dividend Geek owns shares of General Dynamics.

Filed in: Dividend Growth Investing