How I’m Investing in a Post Pandemic World – #5

Let’s take a deeper look into the first ETF WisdomTree Cloud Computing (WCLD). To give you context let’s jump into the exactly what this ETF is made of and look at its holdings. There are 52 individual companies that comprise this fund.

| ETF | Style | Objective | Expense Ratio |

Return |

Yield | Dividend Growth |

Economic Moat |

P/E Ratio |

# of Holdings |

| WCLD | Growth | Capital Growth |

0.45% | Since Inception (9-6-2019) 57% |

0.00% | N/A | Wide 7% Narr 40% |

96.63 | 52 |

Holdings

| Company – Symbol | Weight |

| 1. Fastly – FSLY | 4.89% |

| 2. Zoom Video Comm – ZM | 3.42% |

| 3. Docusign – DOCU | 3.18% |

| 4. Zscaler – ZS | 3.17% |

| 5. Wix.Com – WIX | 2.88% |

| 6. Twilio – TWLO | 2.81% |

| 7. Shopify – SHOP | 2.71% |

| 8. Cloudflare – NET | 2.61% |

| 9. Datadog – DDOG | 2.56% |

| 10. Coupa Software – COUP | 2.50% |

| 11. Square – SQ | 2.39% |

| 12. Crowdstrike – CRWD | 2.35% |

| 13. Veeva Systems – VEEV | 2.32% |

| 14. Five9 – FIVN | 2.31% |

| 15. PayPal Holdings – PYPL | 2.27% |

| 16. 2U – TWOU | 2.21% |

| 17. Okta – OKTA | 2.16% |

| 18. Hubspot – HUBS | 2.10% |

| 19. Pagerduty – PD | 1.99% |

| 20. Avalara – AVLR | 1.95% |

| 21. Domo – DOMO | 1.86% |

| 22. ServiceNow – NOW | 1.80% |

| 23. Tenable Holdings – TENB | 1.75% |

| 24. Elastic Nv – ESTC | 1.74% |

| 25. Ringcentral – RNG | 1.73% |

| 26. Appfolio – APPF | 1.72% |

| 27. Adobe – ADBE | 1.71% |

| 28. Everbridge – EVBG | 1.70% |

| 29. Workiva – WK | 1.67% |

| 30. Q2 Holdings – QTWO | 1.62% |

| 31. Blackline – BL | 1.61% |

| 32. Qualys – QLYS | 1.60% |

| 33. Atlassian – TEAM | 1.60% |

| 34. Box – BOX | 1.51% |

| 35. Yext – YEXT | 1.45% |

| 36. Pluralsight – PS | 1.45% |

| 37. Salesforce.com – CRM | 1.45% |

| 38. Medallia – MDLA | 1.43% |

| 39. Zendesk – ZEN | 1.42% |

| 40. Workday – WDAY | 1.42% |

| 41. Realpage – RP | 1.41% |

| 42. Slack Technologies – WORK | 1.40% |

| 43. Paycom Software – PAYC | 1.39% |

| 44. Mimecast – MIME | 1.39% |

| 45. Paylocity Holding – PCTY | 1.33% |

| 46. New Relic – NEWR | 1.32% |

| 47. Proofpoint – PFPT | 1.23% |

| 48. Dropbox – DBX | 1.23% |

| 49. Smartsheet – SMAR | 1.22% |

| 50. Zuora – ZUO | 1.05% |

| 51. Anaplan – PLAN | 1.04% |

| 52. j2 Global – JCOM | 0.99% |

Business Descriptions of the Top 20 Holdings (52.8% Weight)

- Fastly (FSLY) – operates edge cloud platform, designed to be programmable and support agile software development. The edge cloud complements data center, central cloud, and hybrid solutions. Its customers include digital publishing, media and entertainment, technology, online retail, travel and hospitality, and financial service industries. The company primarily derives revenue from customer usage of its platform.

- Zoom Video Communications (ZM) – provides a communications platform that connects people through video, voice, chat, and content sharing. The company’s cloud-native platform enables face-to-face video and connects users across various devices and locations in a single meeting. Zoom, which was founded in 2011 and is headquartered in San Jose, California, serves companies of all sizes from all industries around the world.

- Docusign (DOCU) – offers the Agreement Cloud, a broad cloud-based software suite that enables users to automate the agreement process and provide legally binding e-signatures from nearly any device. The company was founded in 2003 and completed its IPO in May 2018.

- Zscaler (ZS) – is a security-as-a-service firm that offers its customers cloud-delivered solutions for protecting user devices and data. The firm leverages its position in 150 colocation data centers to deliver traditionally appliance-based security functionality, such as firewalls and sandboxes, as a completely cloud-native platform. The firm focuses on large enterprise customers and offers two primary product suites: Zscaler Internet Access, which securely connects users to externally managed application and websites (such as Salesforce and Google), and Zscaler Private Access, which securely connects users to internally managed applications. Both product suites encompass a broad gamut of capabilities situated across the traditional security stack.

- Wix.Com (WIX) is a cloud-based development platform provider for millions of registered users worldwide. The company is engaged in web development and management that provides an easy-to-use powerful cloud-based platform of products through a freemium model. Its core products consist of three web editors: the Wix Editor, intended for users with basic technological skills, Wix ADI, intended for novice users and Corvid, intended for more tech-savvy users. The company’s web development technology is built based on HTML5 and offers HTML5 compatible capabilities, web design and layout tools, domain hosting, and other marketing and workflow management applications and services. The geographic segments include North America, Europe, Latin America, and Asia and others.

- Twilio (TWLO) is a communication platform-as-a-service company that allows software developers to integrate messaging and communications functionality into existing or new applications via application programming interfaces and software development kits. The firm’s Programmable Communications Cloud addresses several use cases, including Programmable Voice to make and receive phone calls, Programmable Messaging for SMS and MMS delivery, and Programmable Video that allows developers to embed video functionality in mobile and web applications.

- Shopify (SHOP) offers an e-commerce platform primarily to small and midsize businesses. The firm has two segments: subscription solutions (43% of fiscal 2018 revenue) and merchant solutions (57% of fiscal 2018 revenue). The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company’s website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. Merchant solutions are add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

- Cloudflare (NET) is a United States-based company engaged in the software business. It has built a cloud platform that delivers a range of network services to businesses. The product offerings of the company include Argo Smart Routing, Load Balancing, Web Optimizations, Cloudflare Access, and Cloudflare Spectrum among others.

- Datadog (DDOG) is a monitoring and analytics platform for developers, IT operations teams and business users. Its platform integrates and automates infrastructure monitoring, application performance monitoring and log management. The solutions offered by the company include Financial Services, Manufacturing & Logistics, Media & Entertainment and Gaming among others.

- Coupa Software (COUP) is a cloud-based, business spending management platform that provides companies with more control and visibility into how they spend money. Since it was founded in 2006, Coupa has connected buyers with suppliers and helped buyers save money by improving procurement, expense management, and invoice processing. The company is headquartered in San Mateo, California, and went public in October 2016.

- Square (SQ) provides payment acquiring services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. Square has operations in Canada, Japan, Australia, and the United Kingdom; about 5% of revenue is generated outside the U.S.

- Crowdstrike (CRWD) is a cybersecurity vendor that specializes in endpoint protection, threat intelligence and hunting, attack remediation, and offers various solutions to supplement security and network operations teams. Its cloud-based architecture collects data across all its endpoint agents, analyzes the information within its cloud platform, and updates all of its customers’ security posture. CrowdStrike sells packaged tiers of cybersecurity protection and offers individual security modules via its online marketplace. The company was founded in 2011, went public in 2019, and is based in California.

- Veeva Systems (VEEV) is a leading supplier of vertical software solutions for the life sciences industry. The company’s best-of-breed offering addresses operating and regulatory requirements for customers ranging from small, emerging biotechnology companies to departments of global pharmaceutical manufacturers. The company leverages its domain expertise and cloud-based platform to improve the efficiency and compliance of the underserved life sciences industry, displacing large, highly customized and dated enterprise resource planning, or ERP, systems that have limited flexibility. As the vertical leader, Veeva innovates, increases wallet share with existing customers, and expands into other industries with similar regulations, protocols, and procedures, such as consumer goods, chemicals, and cosmetics.

- Five9 (FIVN) is a provider of contact-center-as-a-service software. Its applications are in the early stages of replacing on-premises contact center infrastructure with cloud penetration at roughly 15%. CCaaS solutions support omnichannel communication and include automatic call distribution and interactive voice response. Five9’s intelligent routing solutions can direct customer inquiries to the call center agent best able to handle a customer’s inquiry and suggest the best course of action for an agent to resolve the question quickly and satisfyingly. Over 90% of Five9’s revenue is recurring, with two thirds attributed to subscriptions and one third related to usage (in minutes). The company was founded in 2001 and is headquartered in San Ramon, California.

- PayPal Holdings (PYPL) was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had over 300 million active accounts at the end of 2019, including 20 million merchant accounts. The company also owns Xoom, an international money transfer business, and Venmo, a person-to-person payment platform.

- 2U (TWOU) enables colleges and universities to bring their degree programs online. Its solutions are delivered on a cloud-based software-as-a-service platform, which enables clients to reach students globally. The firm’s flagship online learning environment application, Online Campus, delivers content in a virtual live class setting and facilitates social networking between students. Solutions include content development, student acquisition, application monitoring, and other capabilities. The firm generates revenue through subscription fees to software offerings on a 10- to 15-year basis. A large majority of the firm’s revenue is generated in the United States.

- Okta (OKTA) addresses two primary security concerns via its workforce identity and customer identity solutions. The pureplay cybersecurity firm sells products to protect employees, contractors, and partners as well as its customers’ end users. Okta’s software solutions are cloud-delivered, and its integration network gives customers security protection across a wide variety of applications that are critical to business and government needs. The California-based company went public in 2017 and had over 2,100 employees at the end of the third quarter of fiscal 2020.

- Hubspot (HUBS) provides a cloud-based marketing, sales, and customer service software platform referred to as the growth platform. The applications are available ala carte or packaged together. HubSpot’s mission is to help companies grow better and has expanded from its initial focus on inbound marketing to embrace marketing, sales, and service more broadly. The company was founded in 2006, completed its IPO in 2014, and is headquartered in Cambridge, Massachusetts.

- Pagerduty (PD) is a software company that offers on-call management. Its platform harnesses digital signals from virtually any software-enabled system or device, combines it with human response data, and orchestrates teams to take the right actions in real-time. The product offerings of the company include Analytics, Visibility, Event Intelligence, and Modern Incident Response among others.

- Avalara (AVLR) provides compliance solutions. It provides software solutions that help businesses of all types and sizes comply with tax requirements for transactions worldwide. The company offers a broad and growing suite of compliance solutions for transaction taxes, such as sales and use tax, VAT, fuel excise tax, beverage alcohol, cross-border taxes, lodging tax, and communications tax. These solutions enable customers to automate the process of determining taxability, identifying applicable tax rates, determining and collecting taxes, preparing and filing returns, remitting taxes, maintaining tax records, and managing compliance documents. It generates revenue in the form of subscriptions and professional services.

Style

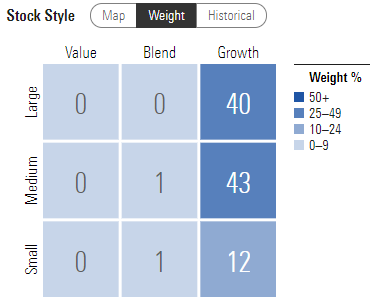

Let’s look at Morningstar’s equity style box for WCLD. A style box which was popularized by Morningstar is a graphical representation of a fund’s characteristics, with market cap size on the vertical axis, and style (value vs growth) on the horizontal axis.

WCLD is clearly a growth fund with the majority of its stock holdings from large and medium cap companies. (See chart below.)

Objective

The primary objective of this fund for my investing strategy (1 of 4 ETF’s) is long-term growth for capital appreciation.

Expense Ratio

WCLD has a 0.45% expense ratio. An expense ratio tells you how much an ETF costs. The amount is skimmed from your account and goes towards paying a fund’s total annual expenses. This means WCLD will cost you $4.50 in annual fees for every $1,000 you invest. You should always consider your costs before investing. Naturally the lower the expense ratio the better. I like to keep my expenses in the 0.2% to 0.3% range. The average ETF carries an expense ratio of 0.44%. I’m okay with WCLD’s higher expense ratio since it only represents 25% of my new holdings, when you include all four of my ETF’s, the expense ratio averages 0.19%.

Return

There is not a lot of history on WCLD it was created in September 2019. Since its inception it is up an astounding 57%. Notice how it underperformed compared to the S&P 500 prior to the start of the pandemic (mid February) but has aggressively outperformed since the coming out of the pandemic sell off in April.

Yield

Currently WCLD does not pay a dividend, as these are aggressive growth companies that are reinvesting their profits back into their companies. Over time some of the companies in this fund may pay a low dividend which will produce a low yield of income.

Dividend Growth

N/A

Economic Moat

Of the 53 companies that make up this fund there is only a 7% weighting of those companies having a Wide economic moat (competitive advantage), and 40% Narrow moat weighting. Overall the weakest moat rating, but that doesn’t surprise me with all of the young aggressive growth companies listed in the fund.

PE Ratio

With the recent price run up WCLD’s PE ratio has an extremely high multiple of 96.63 time earnings. Compare that to the price of the S&P 500 ‘market’ average of 22.22 times earnings, or the tech heavy NASDAQ 100 which is 31.71 times earnings. It appears that a lot of the future earnings are shall we say ‘priced’ into the price of WCLD.

When a stock or fund has a high PE ratio, there is a high probability that it is overvalued, which makes entering a position risky. The best way I have found to reduce the risk of overpaying, and yet still invest is by using a long-term investing strategy called dollar-cost-averaging, which I’ll discuss in a future post.

![]()

Filed in: Investment Principles • Uncategorized