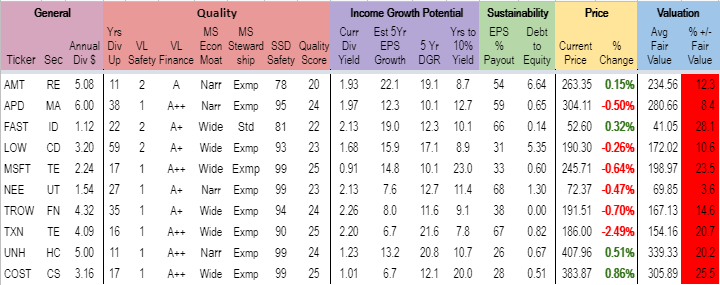

My Top 10 Dividend Growth Stocks for the Long-Term

One of our Dividend Geek slack channel members asked me the question: “If I were to invest in only 10 dividend stocks what would you say they should be?” Here is my response. BTW, I’m looking to hold these Top 10 stocks long-term a minimum of 5 years, preferably over 20 and well into retirement. This is of course assuming that nothing erodes their fundamentals and economic moat and/or annual dividend increases.

For the most part I tried to select a stock from each sector for diversification. I opted to go with two Technology companies (TE) and passed on Energy since the price of oil is so fickle. I would be fine with swapping MSFT out for AAPL and LOW for HD.

Also, you can see by the red valuation column that all of these stocks are currently overvalued. So you wouldn’t want to go ALL IN buying these right now. However, these are really high quality companies and may always be overvalued to some extent and would likely fluctuate between being moderately overvalued to extremely overvalued. The best course of action to buy them would be to dollar-cost-average (meaning buy the same dollar amount each month, equally for each stock). Most brokerage firms have fractional share buying now, so this can be done with any stock now.

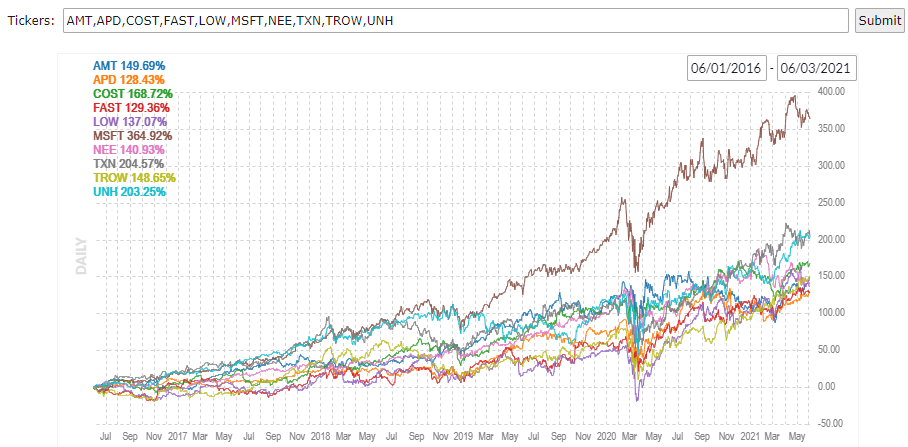

Here is their past 5-Year growth performance. Of course we all know that past performance is no guarantee of future results, but it’s the best SWAG (Scientific Wild Ass Guess) we got.

Full disclosure: I own AMT, APD, FAST, LOW (and HD), MSFT (and AAPL), TXN, UNH.

What would your Top 10 dividend growth stocks be and why?

![]()

Filed in: Dividend Growth Investing

can you please update your “My Top 10 Dividend Growth Stocks for the Long-Term” Thanks

Mike