Dividend Geeks Prospects of the Week – July 13, 2018

This week I’m looking through the Dividend Champions screener. In our case, companies that have raised dividends between 25 to 49 years, because we separate the Dividend Kings (50+ years) into a separate screener. Technically any company that has raised its dividends 25 or more years is considered a Dividend Champion. What’s so great about dividend champions? Well any company that not only paid dividends, but increased their dividend payout for 25 or more consecutive years is most likely a rock star (or a wizard depending on the generation). Why? It’s simple really as the saying goes “dividends don’t lie.” Some companies try to use clever accounting to mask issues, also many economic indicators are open to market interpretation, but when it comes to paying out cash to shareholders, dividends are the most reliable and transparent gauge of company fundamentals.

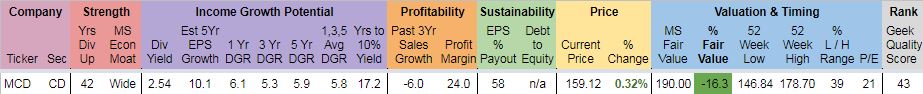

Now let’s get into the prospects. Looking through our Dividend Champion screener I found the following undervalued stocks trading at or near recent support levels. The first company that looked interesting is McDonalds’s (MCD) the fast-food chain giant. Below I provide both my thoughts on each company’s long-term dividend growth investing potential (fundamental’s), as well as some short-term technical analysis on their timing. Enjoy!

McDonald’s (MCD)

Fair value is $190, current price $159.12 which is 16.3% below fair value. MCD has a long 42 year history of increasing annual dividend payments. The dividend growth rate has slowed down to single digit growth rates during the past five years, with a 5.9% 5-year dividend growth rate, I like to invest in companies with a minimum DGR of 5.0% to stay ahead of the historical 3.1% inflation rate during retirement. The great thing about McDonald’s dividend growth rate is that the company historically has rewarded its shareholders with large dividend increases when they have performed well and to be on the safe side, have been conservative with their increases when sales and earning growth has slowed down . Currently sales are down with a -6.0% three year average sales growth rate. However, McDonald’s always seems to find a way to make the necessary adjustments, whether that’s tweaking its menu or the current fresh beef initiative. With a 24% profit margin small improvements can turn things around quickly on the bottom line. I like the Wide economic moat rating, and the 2.5% yield is okay. There solid future earning growth potential (10.1%), and the low 58% payout ratio has plenty of upside potential and safety for dividend growth within the current high single digit rate of dividend growth for years to come.

Technical Analysis

Love this chart!

- Strong support level at $155, there were 8 touches in the past 5.5 months (with the one breakdown exception in early May)

- Price channel trending upwards past 4.5 months

- Current price near bottom of channel

- Entry point range of $159 – $156

The rest of this article is exclusive content for Dividend Geek members.

If you are a member just login and then click ‘Prospects’ on the top menu bar. Today’s article at the top of the list. If you are not a member you can sign up by clicking ‘Join Today!‘

![]()

Filed in: Dividend Growth Investing