Dividend Geek’s Weekly Prospects

This week I’m looking through the Dividend Kings screener (companies that have raised dividends 50 or more consecutive years), there are two undervalued stocks trading at recent support levels Dover Corp (DOV) a diversified industrial company that operates in four segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment. The second is Genuine Parts Company (GPC) a company that distributes automotive replacement and industrial parts in the consumer discretionary sector. Below I provide both my thoughts on each company’s long-term dividend growth investing potential (fundamental’s), as well as some short-term technical analysis on their timing.

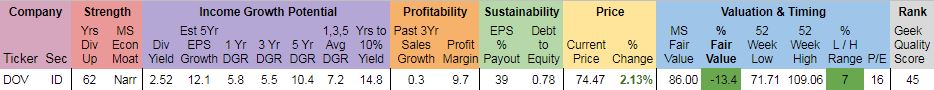

Dover Corp

Fair value is $86, current price $74.47 which is 13.4% below fair value. You can see that these are great numbers across the board. They have raised dividends for 62 straight years! Narrow economic moat, 2.5% yield solid future earning growth potential (12.1%), and the average of the 1, 3, and 5 year dividend growth rates is 7.2%. The 0.3 ‘Past 3 Years Sales Growth’ is likely why the stock is currently undervalued. Solid 10% profit margin, I really like the low payout ratio only 39% of the earning go towards paying the dividend. This allows plenty of future room for raising the dividend in the future, especially if the estimated 5 year earning per share growth holds at 12.1% which is above the 5 year DGR of 10.4%

Technical Analysis

- Forming bottom support in the $72-$73 range

- Trending in a down channel past 5 months, but recent $72 support is above $70 bottom two months ago

- Short term possibilities: More likely to revert to the mean back up to the top of downward resistance trend around $77-$78, then to breach this $72 support level. Notice that I said “more likely” meaning both are possible, just that there is a higher probability of going back up then breaking through the history of support at the $72 price level.

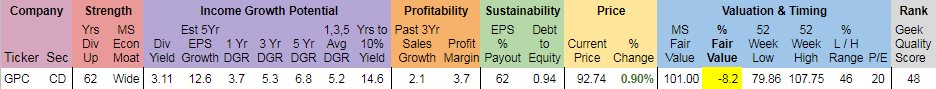

Genuine Auto Parts

Fair value is $101, current price is $92.74 which is 8.2% below fair value. Excellent income growth potential numbers. GPC has raised their dividends for 62 straight years! Wide economic moat, 3.11% yield with solid future earning growth potential (12.6%), and the average of the 1, 3, and 5 year dividend growth rates is 5.2%. The combination of the 3.11% current yield and 5.2% average dividend growth rate (if it can be maintained) would provide a 10% yield-on-cost in only 14.6 years. The 2.1 ‘Past 3 Years Sales Growth’ looks low when compared to other stocks in the dividend kings screener, but the auto part industry past 3 year sales growth has averaged 1.4% so GPC is beating the industry average. Safe payout ratio where 62% of the earning go towards paying the dividend.

Technical Analysis

- Classic ‘Cup-with-Handle’ formation made know by William J. O’Neil of Investor’s Business Daily. In studying charts all the way back into the early 1900’s Mr. O’Neil found this common pattern. What if observed is that if the stock price goes above the tail’s pivot point ($95) it will breakout to the upside into the old base of the cup, in this case towards the fair value line.

- The longer the base “Cup” the stronger the possibility of a break out above the pivot point. The minimum cup length is 7 weeks, GPC’s is about 18 weeks

- Recent one month support at the $90 level

![]()

Filed in: Dividend Growth Investing

Geek –

Tough on here. I would argue that DOV is a little more under valued, based on your metrics above, and I see the most room for significant dividend growth going forward with the lower payout ratio. Thoughts on what you’ll do?

-Lanny

Greetings Diplomats!

Yeah tough choice between these two, they are both solid long-term options, for 20 years out I’d probably go with DOV because of the lower payout ratio, for a 10 year outlook I think GPC will produce more income with the higher current yield and ability to sustain high dividend growth rate due to their 5 year growth outlook. Depends on your investment time-frame.

On a side note… I believe GPC has been beaten down due to the possibility of Amazon getting into selling auto parts, but it’s hard to get the right part without bringing in the part you are replacing into the store for comparison. I can’t image shipping parts online and successfully getting the right part, plus many parts like batteries are really heavy which makes shipping expensive and prohibitive.

Thanks for reading and commenting!

-Dividend Geek