New Profitability Metrics and Updated Geek Quality Score Ranking

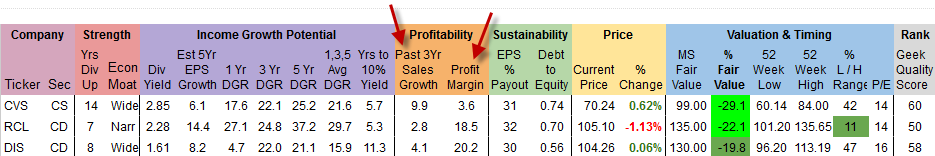

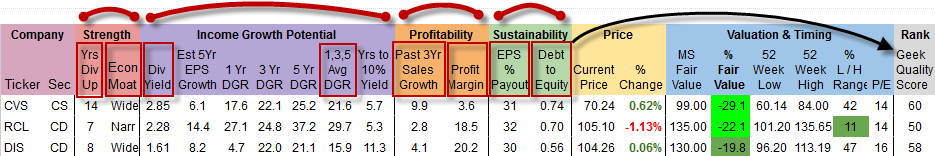

We added two new profitability metrics to all of the Dividend Geek screener pages, the ‘Past 3-Year Sales Growth’ and ‘Profit Margin’ (trailing 12 months). These are the critical ‘top line’ and ‘bottom line’ metrics that make up the foundation of profitability for a company.

Looking over these numbers you can glean a lot of information. I like to go to the Wishlists sector sceeners and compare companies in the same industry to see how their profitability numbers match up against each other. You’ll also notice that many companies with negative sales growth numbers (especially in the Consumer Staples sector) have stock prices trading below fair value and near 52-week lows as wall street has beaten them down, due to their low or non-existent sales growth.

Both of the profitability metrics are part of the ‘Geek Quality Score’ ranking (far right column). The updated scoring system awards an equal share of 25% of the possible points between each of the four quality categories: Strength, Income Growth Potential, Profitability and Sustainability, and each category has two metrics. The eight metrics that make up the ‘Geek Quality Score’ are outlined with red boxes in the screenshot below.

The full point allocation breakdown is as follows:

Strength

- Years Dividend Up

- 25+ years = 12.5 points

- 20 – 24 years = 10

- 15 – 19 years = 7.5

- 10 – 14 years = 5

- 5 – 9 years = 2.5

- less than 5 = 0 (zero)

- Economic Moat

- Wide = 12.5 points

- Narrow = 7.5

- None = 2.5 (for making it onto the website)

Income Growth Potential

- Dividend Yield

- 4.5%+ yield = 12.5 points

- 4.0 – 4.4% yield = 10

- 3.5 – 3.9% yield = 7.5

- 3.0 – 3.4% yield = 5

- 2.5 – 2.9% yield = 2.5

- less than 2.5% = 0 (zero)

- 1, 3, 5 Year Average Dividend Growth Rate (DGR)

- 15%+ DGR = 12.5 points

- 12.5 – 14.9% DGR = 10

- 10 – 12.4% DGR = 7.5

- 7.5 – 9.9% DGR = 5

- 5 – 7.4% DGR = 2.5

- less than 5% = 0 (zero)

Profitability

- 3-Year Sales Growth (source Morningstar)

- 20%+ = 12.5 points

- 15 – 19.9% = 10

- 10 – 14.9% = 7.5

- 5 – 9.9% = 5

- 0 – 4.9 – 2.5

- less than zero = 0 (note to listen to Elvis Costello song)

- Profit Margin (trailing 12 month; source Morningstar)

- 40%+ = 12.5 points

- 30 – 39.9% = 10

- 20 – 29.9% = 7.5

- 10 – 19.9% = 5

- 0 – 9.9% = 2.5

- less than zero = 0

Sustainability

- EPS Payout Ratio (note: for REITs FFO payout ratio is used)

- 35% or less = 12.5 points

- 45 – 34.9% = 10

- 55 – 44.9% = 7.5

- 65 – 54.9% = 5

- 75 – 65.9% = 2.5

- more than 75 = 0

- Debt to Equity

- 0.25 or less = 12.5 points

- 0.5 – 0.249 = 10

- 0.75 – 0.499 = 7.5

- 1.00 – 0.749 = 5

- 1.6 – 0.99 = 2.5

- more than 1.6 = 0 (zero)

The best possible score is 100 points. Although I doubt any company will achieve a perfect score, due to the breadth of quality metrics in the scoring system, so far Altria (MO) has the highest score of 83 points, followed by OZRK with 80, and then seven others with a score of 70.

One other minor change was made to the screener columns. In order to make horizontal room for the ‘3-Year Sales Growth’ and ‘Profit Margin’ columns, we collapsed the Sector column (column 2) down to a two-letter abbreviation. For example, ‘Healthcare’ is now ‘HC’ and ‘Financials’ is now ‘FN’.

Here is the full list of the new two-letter sector identifiers:

- CD – Consumer Discretionary

- CS – Consumer Staples

- EN – Energy

- FN – Financials

- HC – Healthcare

- ID – Industrials

- MA – Materials

- RE – REITs

- TE – Technology

- TC – Telecomm

- UT – Utilities

![]()

Filed in: Website Tools

Thank you for all your hard work, wisdom, and insight. I really enjoy visiting your website and learning about financial freedom.

Best regards,

Shane Merrell