High Yield and High Dividend Growth Companies?

As the English proverb states “You can’t have your cake and eat it too.” The proverb literally means “you cannot simultaneously retain your cake and eat it”. Once the cake is eaten, it is gone. Another meaning of the proverb is that one cannot have two incompatible things.

In the case of dividend growth investing, dividend growth stocks generally fall into two categories. The first is the ‘Low yield with high dividend growth rates.’ These are younger fast growing companies that are able to raise their dividends at high double-digit rates, but have low dividend yields (below 2%). The second type is just the opposite, these are the mature cash cow companies that have passed their high growth stage, but don’t need to reinvest the majority of their profits back into the company, so they can afford to distribute more dividends back to shareholders which provides high yields. Generally speaking this would be companies with dividend growth rates below 5% but nice 4% plus dividend yields.

Similar to the English proverb it seems that high yield and high dividend growth are two incompatible things that fall into two separate categories. But do all dividend growth companies fall into one of these two categories? Now this is where you use your best old English pirate voice:

“Aye, methinks not Captain!”

So the search was on! I decided to uncover dividend growth companies with, both high dividend yields and high dividend growth that would break the typical incompatibility mold, and well you know… so I could have my cake and eat it too!

Do they exist? Actually yes they do! Are they many of them? Well no. In fact, here is the breakdown as to just how rare they are:

- There are 5,868 publicly traded stocks in the USA (excludes the +/- 15000 OTC)

- Of those, 2,387 or 41% pay dividends

- Of those, 874 or 37% qualify as dividend growth companies by increasing their dividend for 5 or more consecutive years

- Of those, only 17 or 2% met my ‘Income & Dividend Growth” criteria:

- 4%+ Dividend Yield

- 8%+ 1 year, 3 year and 5 year average dividend growth rates (only one of the three could be below 8% (6%-7.9% range) with the exception of Realty Income (O) because it raises dividends quarterly and pays dividends monthly.

- 6+ Years of consecutive dividend increases

- Dividend payment amounts are consistent (this disqualified Enbridge ENB)

- EPS % Payout ratio below 100% or in the case of REITs and BIP ‘FFO % Payout’ (funds from operations)

- No industry or company uncertainty overshadowing its financial performance (i.e.: QCOM licensing litigation with Apple)

- I also excluded many MLPs due to their complicated tax structure or high debt, and there were other REITs that met the criteria so I only included the top 5 REITs.

As a dividend growth investor I look for strong fundamentally sound companies that can continue their past financial performance into the future. I strive to have a portfolio that provides both high yield for income and high dividend growth to keep ahead of inflation, and raise my standard of living during retirement. As a general rule of thumb I have been shooting for a reasonable but bit of a stretch for a 4% yield and 10% dividend growth rate. I have been able to achieve this using the current Dividend Geek screeners by investing in a mix of both types of dividend growth stocks (high growth/low yield and low growth/high yield).

With the addition of the new ‘Income & Dividend Growth’ screener I believe I can raise my income and dividend growth sights a little higher by including many of these best of both ‘have your cake and eat it too’ companies into my existing portfolio.

So in this case I think Dwight is right!

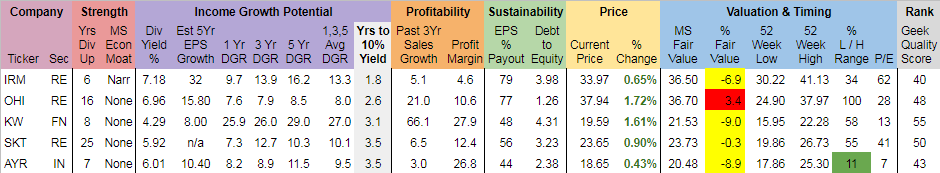

Here are the current top 5 companies listed in the ‘Income and Dividend Growth’ screen.

To see the other companies on this screener as well as getting full access to our other dividend growth stock screeners and tools simply login (members) or sign-up then select ‘Screeners’ from the menu bar.

All the best!

![]()

Filed in: Dividend Growth Investing