Step 2 – Use the Best Source of Passive Income

This post is the second of a four step ‘Financial Freedom Kick-Starter Tutorial’ that I am working on. The objective is to provide everything you need to know to start your journey to financial freedom.

What is Passive Income?

According to Wikipedia: “Passive income is income resulting from cash flow received on a regular basis, requiring minimal to no effort by the recipient to maintain it.” Currently your income is likely active income, which means that the money you earn is tied to your time. The more time you work the more money you earn. In other words, you’re trading your time for money. If you want to earn more you’ll need to either work your butt off to gain a promotion (that’s higher than the 3% inflation rate) or work more hours… This is how we have all been taught the world and money works.

There are two problems with active income:

- Your time is limited, so trading it for money is not a very good deal!

- You depend on your job (and its income) too much – if you lose your job, or your employer folds – poof! Your income stops.

If you earned passive income, you’d be able to change your life!

Passive income fixes both of the above problems. Once you start earning it, you immediately get more freedom to do the things you want to do, because you’re getting paid regardless of what you do with your time! The more passive income you can earn the less you will be dependent on your job.

You need to start generating passive income!

But how do you actually earn passive income?!” Let’s face it not all sources of “passive” income are equal. You must always do something – at least initially. Whether that something is small or big depends on the type of passive income.

The real question is this…

What is the best source of passive income?

In other words, which one has the best balance between work and income? Also, another important factor is growth. Does it grow each year above the rate of inflation, so you don’t lose purchasing power?

My three passive income qualifiers are:

- Little to no work required

- High initial income

- The income continues to grow each year without any work.

This is the kind of passive income that leads to financial independence.

Here’s how common types of “passive” income match up to the three qualifiers:

| Source | No Work | High Income | Growth |

| Bonds and other fixed-income | Yes | No | No |

| Creating a product that sells itself | No | Yes | Maybe |

| Writing a book, or other intellectual property | No | Yes | No |

| Blog, podcasts, YouTube channel, etc. | No | Yes | Maybe |

| Rental Property | No | Yes | Yes |

| Dividend Growth Investing | Yes | Yes | Yes |

The best source of passive income without a doubt is dividend growth investing.

Why is it so good? Because it gives us sufficient initial income that continues to increase every year. It’s easy to set up and then requires virtually no work ever again!

What is Dividend Growth Investing?

Good question! It consists of buying stocks of companies that pay dividends which makes you a shareholder. As a shareholder you’re entitled to the dividends that the company distributes to shareholders usually every quarter! Literally, the money gets sent straight to your account – like clockwork. But that’s not all! Dividend Growth Investing (DGI) is not only investing in companies that pay a dividend, but more importantly they have a long history of actually increasing their dividend payment every year – without fail.

These are large strong well established companies that have grown to the point where they can give part of their profits to their shareholders (dividends). Not just any random companies. You probably use their products most days! The point is that these are stable growing companies that have competitive advantages (economic moats) they’re great at what they do, and they’re profit machines committed to sharing their profits with their shareholders.

The real beauty of investing in companies that increase their dividend payment every year is that they will unlock options in your life that you never thought were possible. Like reaching financial freedom one day and never having to work for money ever again!

The Power of Dividend Growth

This is it! – What I’m about to teach you in the following tutorial steps is a revolutionary way of investing. After 20 years of investing in the stock market and trying many different “investing” methods, with mixed results I discovered a group of investors on the internet who were dedicated to this successful investing approach. It is not a get rich quick scheme or short-term fix.

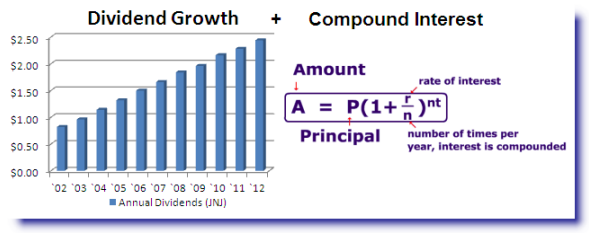

You have probably heard about the power of compound interest. It’s believed that Albert Einstein said: “The most powerful force in the universe is compound interest.” In the case of stocks reinvested dividends is the equivalent to compound interest.

What you probably haven’t heard of is a second powerful compounding factor called Dividend Growth it’s the best kept secret on Wall Street.

Dividend growth is when a company raises their dividend payment each year. There are many great companies that have raised their dividend on average of 10% a year… for over 25 consecutive years! This goes unnoticed to most people as they trade in and out of stock regularly; but, with a long-term horizon if you reinvest dividends that are also growing larger every year, you can create a powerful compounding money machine!

Based on mathematically proven principles.

Most long-term investment systems utilize compound interest – that’s nothing new. Dividend Growth Investing (DGI) is unique in that it uses the power of dividend growth and combines it with compound interest to turbo-charge the compounding effect. The combination of these to compounding elements is the mathematical force that produces inevitable ever increasing higher returns. It takes time for the compounding to reach exponential growth, so the earlier you start the better.

Enjoy Life and Make the World a Better Place

When you achieve financial freedom you can start using your most precious resource, time, in more efficient and better ways, because you no longer have to slave away the days trying to earn an hourly income to pay the bills. By following dividend growth investing principles you can achieve financial freedom so you can stop working for a living with enough income to enjoy life and help others. The amount of free time you’ll have depends on how soon you start. The earlier you start the better and the more time you will have.

I strongly believe that the more people who can become financially independent and no longer have to work to support themselves, the more people will have the time and the means to pursue helping their family and others. This also reduces or eliminates the potential financial burden that they could place on their family and society in the future – a win/win!

The Possibilities Are Unlimited!

Think of it… when people are freed from financial bondage; it puts them in the best position to help others. They not only have the money, but the time, energy and health to make a real positive impact and difference in the world.

Filed in: Dividend Growth Investing • Investment Principles