New Portfolios for Dividend Growth Investors!

If you do not have the time to screen stocks or are not sure how to build a diversified portfolio you can refer to our sample portfolios! Each portfolio consists of the strongest dividend growth companies from each sector to build a diversified portfolio.

In general, stocks with lower dividend yields and faster dividend growth are suitable for younger investors that are looking to maximize total returns, while stocks with higher yields and less growth are suitable for those close to retirement or retirees that want to live off the income now.

Here are the names of the three sample age group portfolio’s listed in the ‘Portfolios’ drop-down menu:

- High Dividend Growth (youngest)

- Balanced Dividend Growth and Income (youngish)

- High Income (most people at work are younger than me)

These portfolios are designed for long-term investors who use high quality dividend growth stocks to build a growing income stream for retirement. They include companies with stable business models, quality balance sheets, and a history of dividend growth. Ideally the timing of when you purchase a company is when it is trading near or below fair value.

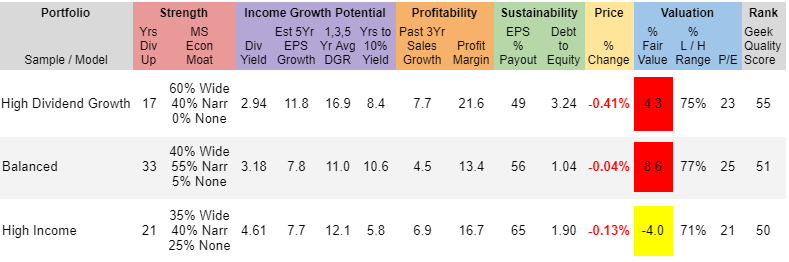

Here is a snapshot as of today (4-16-2019) of the averages for each portfolio’s metrics. This comparison dashboard can be accessed from the ‘Portfolios’ drop-down list on the top menu.

Building a stock portfolio is a combination of both art and science. You might focus on one of the three sample portfolio’s that fit your age or build a custom portfolio that matches your investment objectives by utilizing all three sample portfolios.

Investment Profiles

High Dividend Growth

- Target – Investors seeking to maximize retirement income and total returns through dividend growth

- Years to retirement – 30 to 40 years

- Risk – Lowest

- Dividend Yield – 2% to 3%

- Dividend Growth – >13%

Balanced Dividend Growth and Income

- Target – Investors seeking to build retirement income through a balance of dividend growth and dividend income

- Years to retirement – 15 to 30 years

- Risk – Low to Moderate

- Dividend Yield – 3% to 4%

- Dividend Growth – 10% to 13%

High Income

- Target – Investors seeking to build or establish retirement income through initial dividend yield, while growing income above the rate of inflation in retirement

- Years to retirement – 15 years or less

- Risk – Moderate

- Dividend Yield – 4% to 5%

- Dividend Growth – >8%

*Disclaimer: Always do your own due diligence. Companies listed in the sample portfolios are not recommendations.

All the best,

Filed in: Dividend Growth Investing • Website Tools