Why I Bought 1 Share of WestRock in my IRA Account

Because I could! That is without a commission cost for the first time. Yes the race to zero has finally arrived. After decades of “discounts” ranging from $19.95 to the more recent $4.95 standard commission cost. Monday Oct 7, 2019 marked the first day of 0$ commission trades at major online brokers Charles Schwab, TD Ameritrade, and E-Trade.

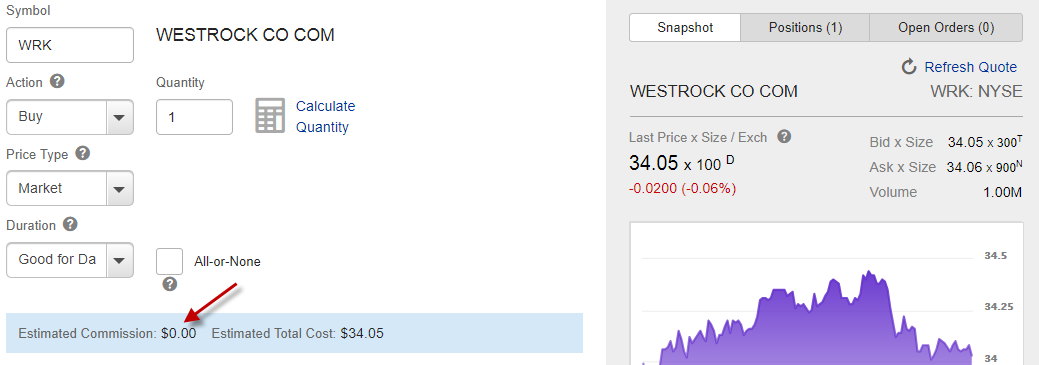

Why only 1 share? Well it just seemed too good to be true, so I tested it to make sure. Yes it worked. I even pinched myself. It’s real folks! Here’s what is looked like on my E-Trade IRA account.

I suppose I could have chosen any company to buy to test this, but I decided to scan my high yield and high dividend growth rate screener and it indicated WestRock (WRK) was undervalued and trading within 10% of it’s 52 week low. Not to get into the details of why I bought WestRock (it’s not the main point of this article). Suffice to say that I already own WestRock and like it’s long-term prospects.

How will 0$ Commission Impact Investors?

- Lower Expenses – I looked back over the past three years and found that I average about 80 trades per year (I have several brokerage accounts) at the previous standard discount commission rate of $4.95 per trade this will save me nearly $400 annually. Naturally this will vary depending on the trading activity of the investor. But bottom line there is an immediate savings to investors that can be used for additional investing.

- Improved Compounding – When my commission costs were $4.95 per trade I would save up $2000 in cash (from dividends and contributions) before making my next investment to keep my expense ratio low. I don’t automatically reinvest dividends (DRIP) back into the same stock, but prefer to reinvest them into a company that is trading at a deeper discount to fair value. Now I can put my cash to work sooner which will improve the compounding effect of each of my portfolio’s.

- Faster Diversification – For the same reasons noted in #2 (not having to save up $2000 to make your next stock investment). New investors who are in the process of building a diversified portfolio using individual stocks, will now be able to invest in companies across all sectors (Consumer Staples, Energy, Healthcare, Financials, Tech, Utilities, etc.) faster by buying in smaller dollar amounts.

- Short-Term Capital Gain Losses – On the negative side, inexperienced investors who have not established a successful long-term investment philosophy may be more tempted to increase their trading frequency and time-the-market. Studies have shown that market timers lag the S&P 500 benchmark by an average of 4.66% per year.

Conclusion

Major online brokers are now offering zero $ commission costs which includes retirement accounts, and not just cash accounts (Robinhood). Zero commissions will lower your investing expenses and depending on how you invest may improve the compounding rate and diversification of your portfolio. Be careful not to let zero commission costs change your core investment strategy and plan.

Filed in: Dividend Growth Investing